GSs are particularly wide-spread in Italy and Portugal where the outstanding volume of SME credit guarantees stands around 2. 44 0 1273 763400 Fax.

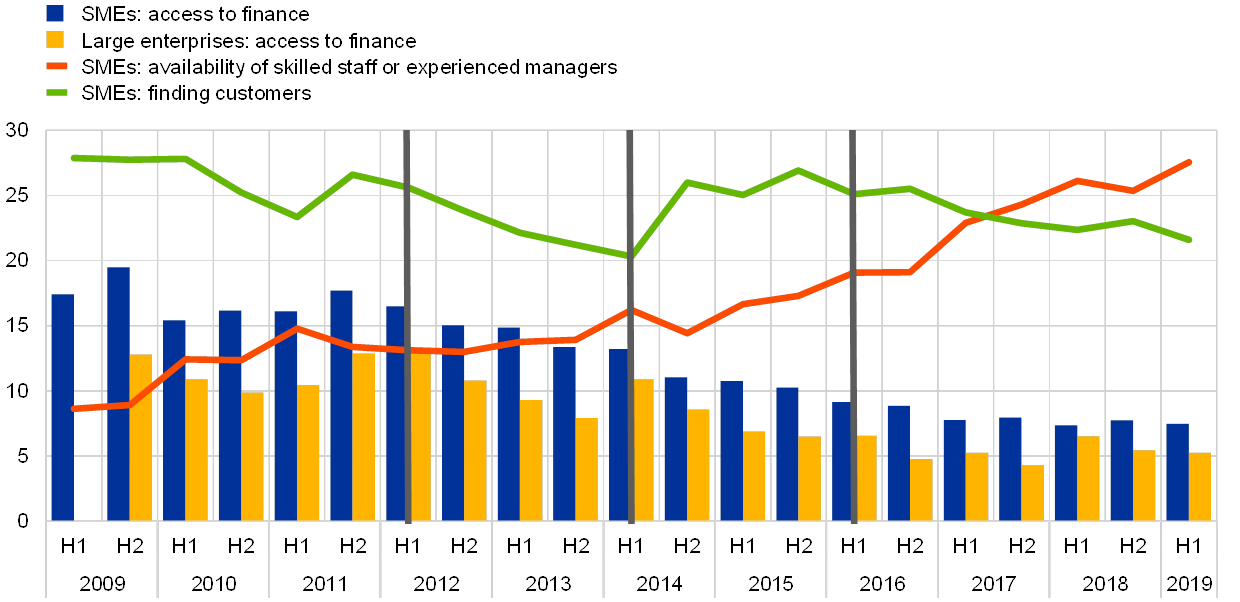

Access To Finance For Small And Medium Sized Enterprises After The Financial Crisis Evidence From Survey Data

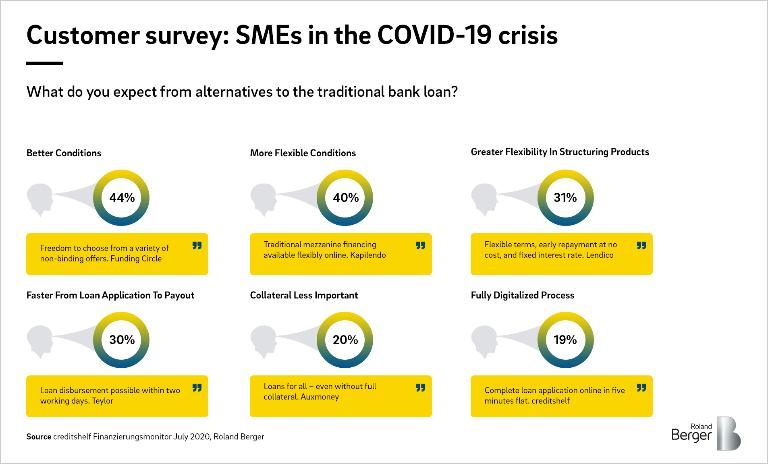

SME demand for finance is set to continue to grow globally in 2022 bringing with it a surge in prevalence of embedded lending which is still ripe for the taking in Europe.

Sme lending germany. Acknowledgements The Institute for Employment Studies The Institute for Employment. Modern SMEs are large contributors to the creation of workplaces and economic growth especially in developing countries. ING in Germany and Amazon join forces in SME lending 30 June 2020 2 min read Listen ING is the first bank in Germany to cooperate with Amazon in offering loans to eligible sellers mainly small and medium sized enterprises SMEs through Amazons seller portal.

The program now solely targets SMEs at 5 GBP funding for every 1 GBP net lending until January 2015. SME credit guarantees in Western Europe In many Western European countries credit guarantees play a key role in supporting SMEs access to finance. In Germany for example 807 percent of the 29 million non-financial companies are small with less than 10 employees 156 percent have 10 to 49 employees and 29.

Investing in enterprises usually small and medium SMEs typically brings lower average interest rates than the other opportunities but remember lower return usually means lower risk. MRO rate While the ECB has dropped by 135 basis points since October 2011 and is now close to zero lending. Germany has a strong culture of loan-based SME financing.

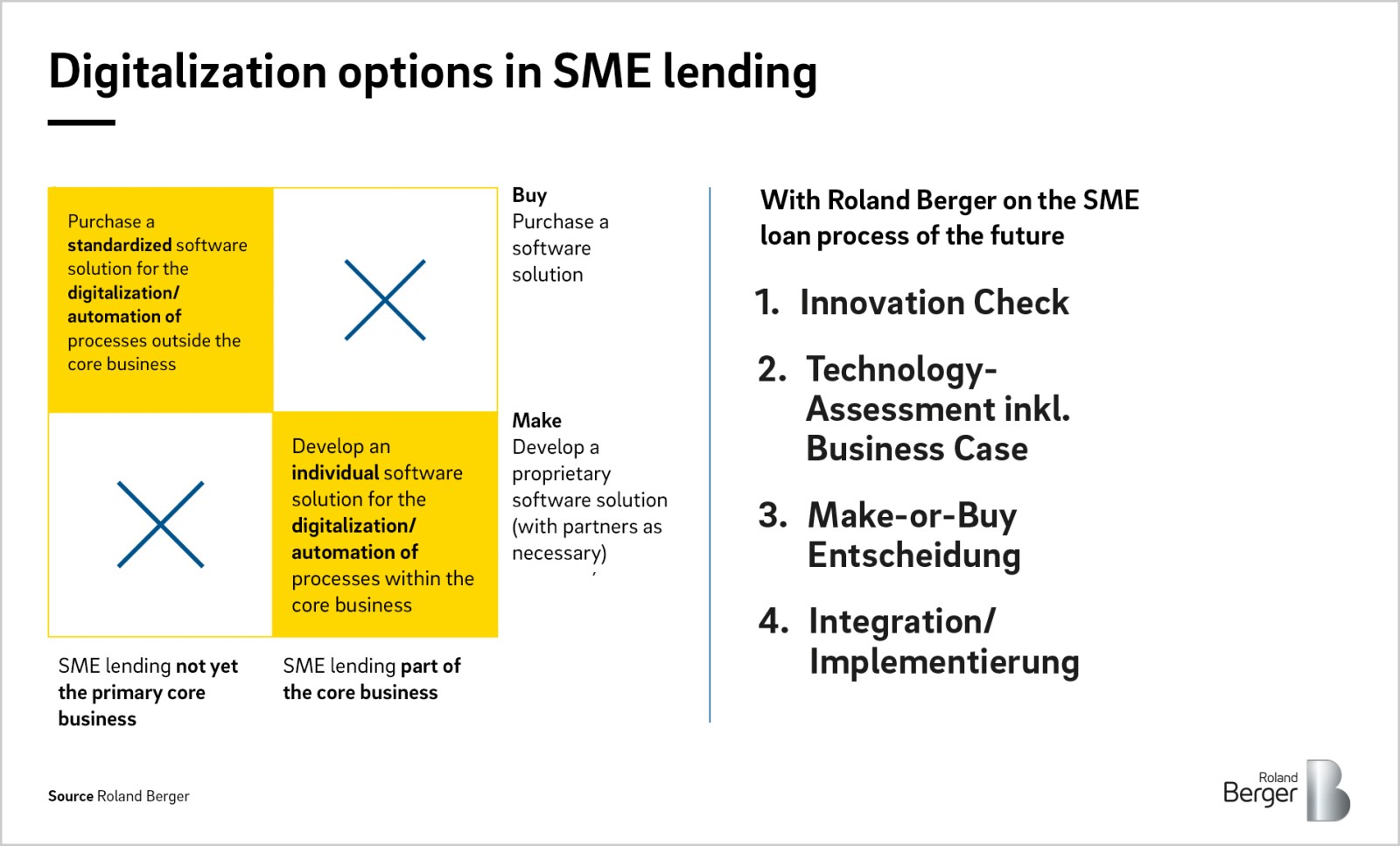

In addition this automation greatly enhancing. They generate 60 percent of all corporate revenues making them the mainstay of the German economy. Unlocking lending in Europe Bank lending in the EU European Investment Bank Page 3 of 52 The difference between interest rates of bank loans NFCs and the ECB policy to rate has risen suggesting weak monetary transmission.

Apart from this players from other countries are beginning to show interest in the German market. Everyone has the opportunity to invest in selected companies online equity-based crowdfunding or crowdinvesting and lending-based crowdfunding ie money for interest and to benefit from. This includes unlimited sized.

Given the remarkable market opportunities in. More than 99 percent of companies in Germany count as small and medium-sized enterprises SMEs. We also lend into niches and segments not served by our local lenders.

GREEN ROCKET is the first crowdfunding platform in Europe that specializes in companies dealing with the future issues of energy the environment mobility and health. Deutsche Bundesbank Eurostat Solarisbank KfW Roland Berger of German companies of revenues of corporate lending 9995 60 36 5 Bundesbank destatis 2018 6 OECD 2020 7 KFW 2020 The future of SME lending 5. Although the national frameworks of CGSs show a large country-by-.

Recently Finnish P2P credit marketplace Fellow Finance. And they need access to lending. In absolute terms the guarantee sector is largest in Italy outstanding volume.

This dual approach gives us a wide data set for SME lending across Europe and unique insights that in turn allow us to improve our own credit models and risk management ABH Holdings is funding the transformation of the old ATB a bank that relied on manual often paper-based processing. 44 0 1273 763401. 25bp for banks that maintain or expand their lending.

For instance Paris-based Qonto raised 136 million million London-based Tide raised 156 million and Amsterdam-based Finom recently raised 17 million in venture capital. As Europe begins to see an increase in competition and transparency in the lending marketplace lending services begin to become digitized requiring banks to adopt new technology in order to remain relevant to their SME customer base. The fee increases if the bank decreases its lending volume while using the program As mortgage lending has recovered the allowances under the FLS scheme for lending to households ended in January 2014.

With a market share of 177 Germany is the second-largest market for peer-to-peer P2P investing in Europe surpassed only by France. The German government has signed-off on a 750bn euro support package as well as emergency aid loans guarantees and stakes in companies to keep businesses afloat. Second Germany has a banking system in which local.

The cooperation with Amazon opens up a new digital sales channel for ING in Germany. Its hard to imagine a well-diversified P2P investment portfolio. Italy and Portugal where the outstanding volume of SME credit guarantees stands around 2 per cent of the GDP.

EUR 336bn France EUR 167bn Germany EUR 56bn and Spain EUR 41bn. Several well-funded fintech companies that exclusively focus on serving the freelance or SME market segment have been founded in Europe over the last years. SME lending and competition.

For quite some time banks have been skittish about lending to small businesses due to the high total costs estimated at 3000 per loan. Germany provides a particularly useful environment to test our hypothesis because of two institutional features. First 96 percent of all firms in the German economy are SMEs according to the definition of the European Commission 2006 which enables us to focus on SME lending.

An international comparison of markets. Main Funders charges 045 of the loan amount from the borrowers and charges 02 from investors. Its about time that small businesses across Europe were offered alternative routes to accessing credit.

This gives the region a head start towards more open data sharing practices with the end result being further innovation. The Current State of SME Lending Modern Small and Medium Enterprises SMEs represent a significant part of the global economy accounting for nearly 90 of all modern businesses. For this reason the ministry closely looks at the impact of financial regulation on SME financing for SME s its availability and the exact conditions.

P2P investing covers crowdfunding models where it is possible to make a profit as an investor with the largest and most famous business models being peer-to-peer lending also. Global SME lending fintech Tradeplus24 is launching into the UK with the close of a 30 million debt facility provided by San Francisco. A The German SME market The German SME segment offers great potential in Source.

Our work with the likes of Metro Bank and Esme Loans has shown that a digital automated solution significantly reduces the acquisition cost and can make SME lending profitable. The German Market for Peer-to-Peer Lending. In this paper we use five German and UK bank case studies to test and extend a conceptual model of risk assessment in bank lending to SMEs.

It offers SME loans ranging from EUR 200 thousand to EUR 10 million for a maximum period of 5 years. Million SMEs in Europe which employ 886 million workers and produce 3357 billion Euro of gross value added. INSTITUTE FOR EMPLOYMENT STUDIES City Gate 185 Dyke Road Brighton BN3 1TL.

Moreover the majority of companies in Europe are small. Business lending is one of the top three branches of peer-to-peer investments next to personal and real estate lending.

Access To Finance For Small And Medium Sized Enterprises After The Financial Crisis Evidence From Survey Data

Sme Lending In Transition Opportunities To Develop Future Oriented Business Models Roland Berger

Cap Structure Sme Eu Png Finance Bank Sba Loans Risk Management

Sme Lending In Transition Opportunities To Develop Future Oriented Business Models Roland Berger

Sme Lending In Transition Opportunities To Develop Future Oriented Business Models Roland Berger